Provision for Doubtful Debts Double Entry

It is calculated to cover the cost of debts that are expected to remain unpaid during an accounting period. Scenario B1 Scenario B2 - Entry 2 Scenario C - Entry 3 Scenario D.

What Is An Allowance For Doubtful Debts Financiopedia

Accounting Journal and Ledger Quiz.

. If a business along with its assets and liabilities is transferred by one owner to another the debt so transferred by one owner should be entitled to the same treatment in the hands of the successor. Assets Liabilities Capital. Try Another Double Entry Bookkeeping Quiz.

B Of a Not-for- Pro t making concern i Preparation of Receipts and Payments Account. 5000 are outstanding for salaries. Double entry bookkeeping part A 3.

Ii An unrecorded creditor of Rs. Guarantee product warranties Requirements for creating provision. 1000 are prepaid for insurance.

Double entry bookkeeping part B 5. The mootness of the case in relation to the WMCP FTAA led the undersigned ponente to state in his dissent to the Decision that there was no more justiciable controversy and the plea to nullify the Mining Law has become a virtual petition for declaratory relief26 The entry of the Chamber of Mines of the Philippines Inc however has put into focus the seriousness of the allegations of. Other items Purchase return capital bad debt recovered.

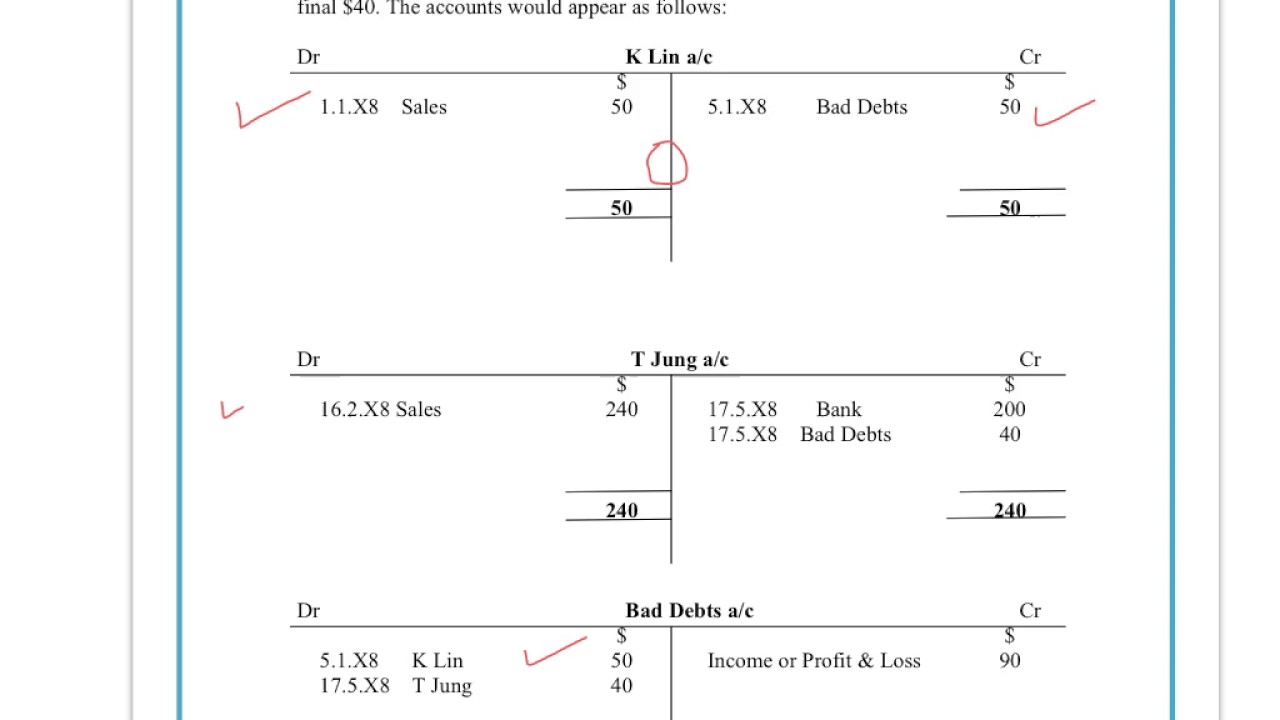

Depreciation and disposal of fixed assets. Bad debts and provision for doubtful debts. General reserve provision for doubtful debts.

Other items Sales return reserve for discount on accounts payable. For example here is a debtors ledger with a number of individual. Treatments to record adjustments for accruals and prepayments bad debts provision of doubtful debts and bad debts recovered are included.

Iii Patents will be completely written off and 5 depreciation will. I Accounting treatment of bad debts reserve for bad and doubtful debts provision for discount on debtors and provision for discount on creditors. 5 Preparation of Financial Statements.

20000 will be recorded. Enter the email address you signed up with and well email you a reset link. The solution for this question.

Goodwill was not brought in to firm. As previously mentioned we not only have the general ledger but also two other subsidiary or supporting ledgers. Business documents and books of prime entry.

If this occurs during the accounting year then the company can DIRECTLY write it off in the Income Statement otherwise a Provision needs to be created for. 5 provision be made for doubtful debts on Debtors and a provision of 2 be made on Debtors and Creditors for discount. A provision can be created due to a number of.

Ii Preparation of Trading Account Profit Loss Account and Balance Sheet. As per Double Entry System of Book Keeping every transaction affects two sides ie. The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below.

FRA 42715- Donated assets to the Crown has been replaced by FRA 42712-Gifts to the CrownAddition - SPAs Cost-SharingJoint Project Agreements - an example of a cost-sharingjoint project agreement to be accounted for under Scenario A has been added. Examples include accounts payable bills payable wages payable interest payable rent payable and loan payable etc. V Creditors were unrecorded to the extent of 1000.

Enter the email address you signed up with and well email you a reset link. Provision For Doubtful debts takes into consideration that when a company conducts it business there is bound to be some billings during the year whereby the customers might not be able to pay hence eventually turning bad. Ram started business with cash Rs.

The other examples of provisions are. Liabilities are obligations or debts payable to outsiders or creditors. Inventory valuation and its impact on financial statements is also covered.

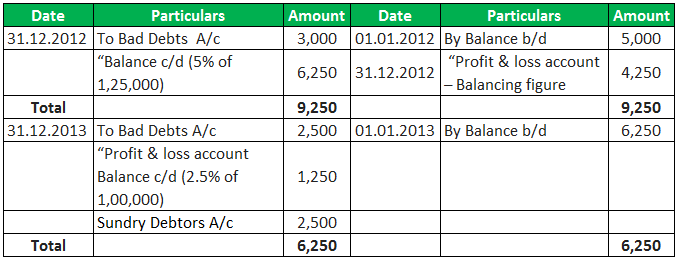

The Trial Balances. The system of recording transaction based on this principle is called as Double. A provision for bad and doubtful debts is to be created at 5 of debtors.

24000 will be written off as bad debts and a provision of 5 on debtors for bad and doubtful debts Will be maintained. It is to be noted that in case of decrease in value maximum amount that can be charged to the revaluation surplus account is limited to the remaining balance in surplus account. The emphasis of this section is the preparation of financial statements including year-end adjustments for different types of.

The title of a liability account usually ends with the word payable. Provision for discount on accounts receivable etc. 6000 have been omitted be recorded in the books.

We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. Petty cash book. More guidance has been provided in the introduction on.

56667 40000 and company needs to pass adjusting entry as follows. Pass the necessary journal entries prepare the revaluation account and partners capital accounts and show the Balance Sheet after the admission of C. Due to this principle the two sides of Balance Sheet are always equal and the following accounting equation will always hold good at any point of time.

Besides these any revenue received in advance is also a liability of the business and is known as unearned. In that case there is a revaluation loss of 16667 ie. - The Debtors Ledger - The Creditors Ledger.

Carrying value of asset after the above adjustment would be. The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an. 1480 for accrued income are be shown in the books.

I Debtors of Rs. Bad debts should be written off when accounts are made up ix. Accruals and prepayments.

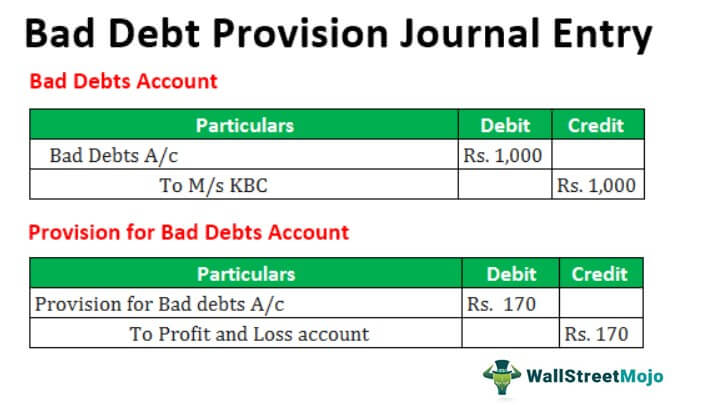

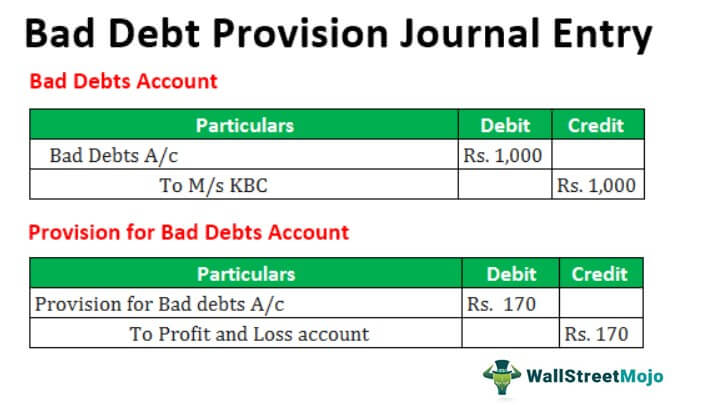

Bad Debt Provision Accounting Double Entry Bookkeeping

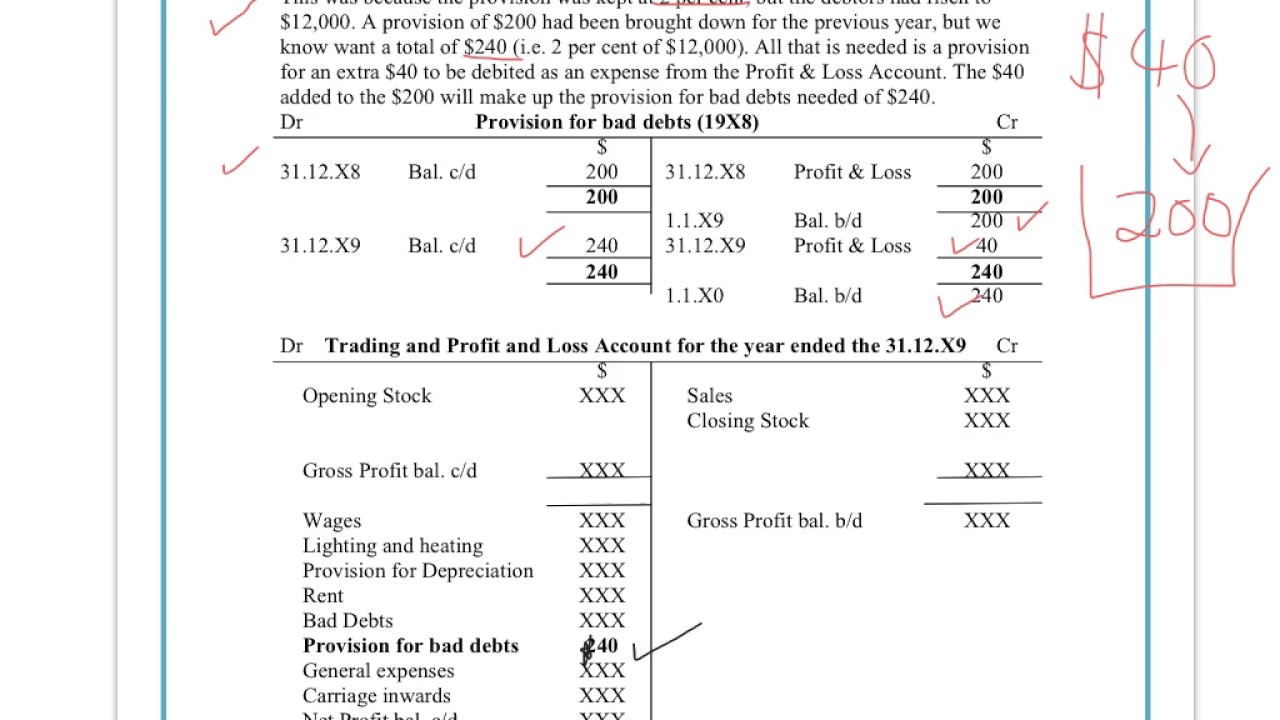

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Allowance Method For Bad Debt Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Igcse Gcse Accounts Understand How To Enter Bad Debts Transactions Using The Double Entry System Youtube

0 Response to "Provision for Doubtful Debts Double Entry"

Post a Comment